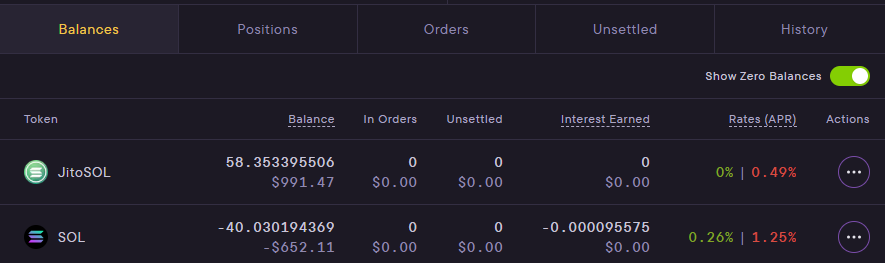

Mango is a cross-margined DEX that supports trading perpetuals and spot assets. If you deposit JitoSOL, you will be able to use the token as collateral value to support positions on these assets. Any deposited assets automatically earn interest as well.

For instance, you can go long SOL perp using JitoSOL as collateral. This enables greater exposure to SOL price moves. Alternatively, one could short SOL perps while holding JitoSOL in Mango to hedge price risk while earning staking rewards (and potentially fund rates).

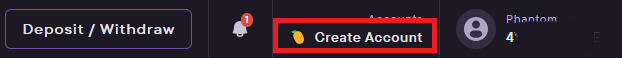

Setup Mango Account

You must have a Mango account to use JitoSOL. Go to the app and create an account if you don't already have one.

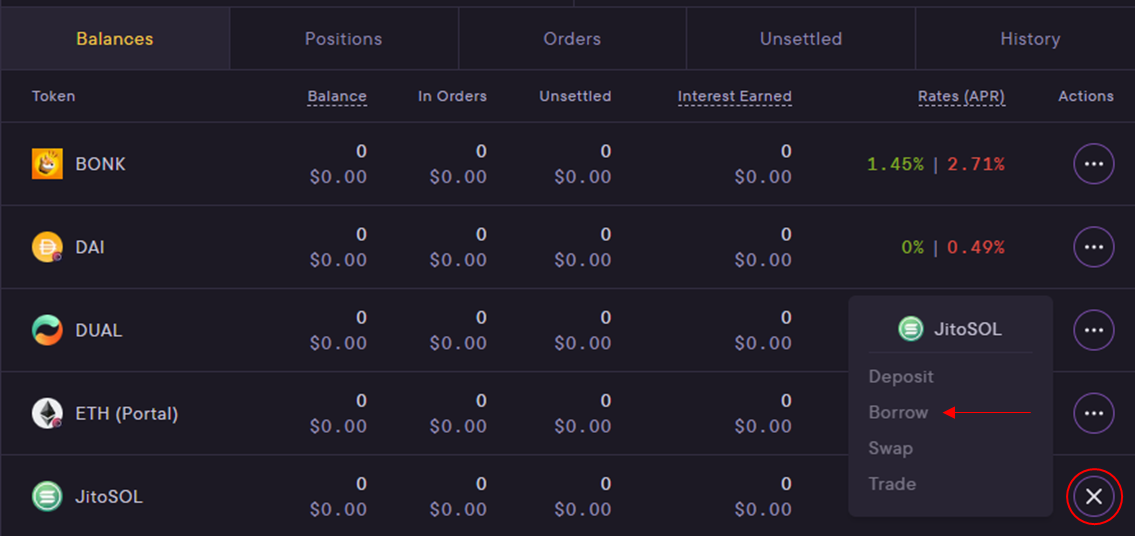

Deposit JitoSOL

Once your account is setup, you can deposit JitoSOL on the account home screen. Click the options action on the right column of JitoSOL and deposit your chosen amount into Mango.

Once deposited your JitoSOL automatically begins earning interest and counts towards your collateral value on Mango.

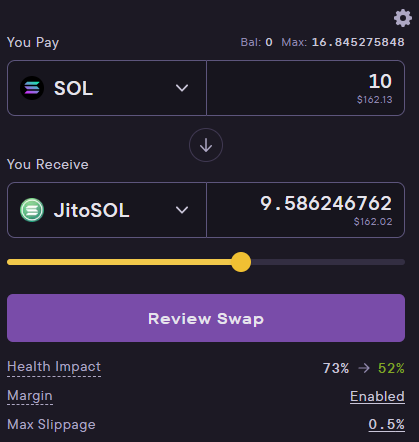

Leveraged Staking

Mango can be used to easily loop or leverage your JitoSOL stake. This strategy involves borrowing SOL against the value of your JitoSOL position, then converting the borrowed SOL into JitoSOL. If SOL borrow cost is lower than the JitoSOL rewards (~7%), it amplifies the yield on JitoSOL.

To do this, use the Swap page on Mango to swap SOL for JitoSOL as shown below.

Note, there are risks anytime you are using margin. You can be liquidated and lose your original investment if leverage is too high or JitoSOL has a substantial depeg vs. the SOL price.

Please do your own research and understand the risks of the strategy.