Kamino Finance

Kamino Finance is Solana's leading automated vault protocol with over $2.4 billion TVL. Kamino creates actively managed liquidity strategies that optimize yield farming across concentrated liquidity AMMs like Orca, Meteora, and Raydium.

JitoSOL Integration

Kamino offers multiple vault strategies featuring JitoSOL, with the JitoSOL-SOL vault being the largest liquidity vault on the platform.

Key Advantages

Automated Management: Kamino removes the complexity of maintaining concentrated liquidity positions by:

- Automatically rebalancing positions based on market conditions

- Compounding rewards continuously

- Optimizing fee collection ranges

Enhanced Yields: Vault strategies earn from multiple sources:

- Base JitoSOL staking + MEV rewards (~7.5%)

- Trading fees from liquidity provision

- Additional protocol incentives when available

- Automated compounding for maximum efficiency

Major Vault Strategies

JitoSOL-SOL Vault (Recommended)

- TVL: Largest vault on Kamino

- Platform: Primarily Raydium with Orca integration

- Risk: Low (both assets are SOL-based)

- Yield: Staking rewards + trading fees + incentives

Benefits:

- No impermanent loss risk (assets are price-correlated)

- Earn full staking rewards on both sides

- Additional trading fees from JitoSOL-SOL swaps

- Automated position management

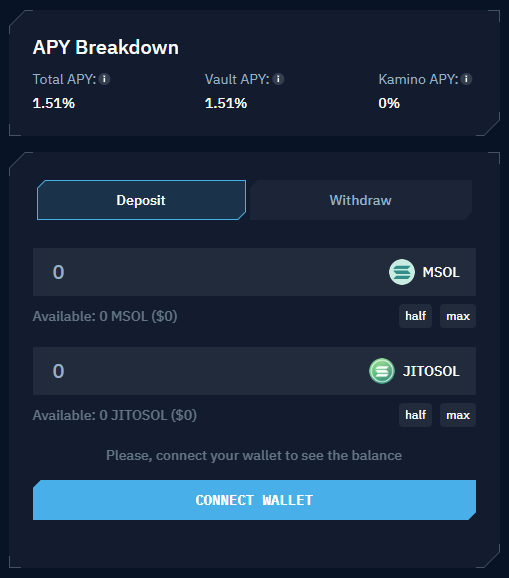

Getting Started

- Visit Kamino: https://app.kamino.finance/

- Connect Wallet: Link your Solana wallet containing JitoSOL

- Choose Vault: Select JitoSOL-SOL for lowest risk or mSOL-JitoSOL for diversification

- Deposit: Add your JitoSOL (and SOL if needed for balanced deposits)

- Earn: Automated yield optimization begins immediately

Performance & Fees

Fee Structure:

- Management Fee: Typically 2-5% of yield (varies by vault)

- Performance Fee: Percentage of profits generated

- Withdrawal Fee: Usually minimal or none

Historical Performance: While displayed APY may appear lower (1-5%), this excludes the underlying staking rewards from JitoSOL and mSOL. Combined yields are higher when including:

- Base staking rewards

- MEV rewards

- Trading fees (0.5-2% depending on volume)

- Additional incentives when available

Resources

- Platform: https://app.kamino.finance/

- Documentation: https://docs.kamino.finance/

Important: Always understand the specific strategy and risks before depositing. Start with smaller amounts to familiarize yourself with the platform's mechanics.