Meteora

Dynamic liquidity market maker with JitoSOL-SOL pools

Meteora offers Dynamic Liquidity Market Maker (DLMM) pools that arrange liquidity into distinct price bins, providing concentrated liquidity with automated optimization.

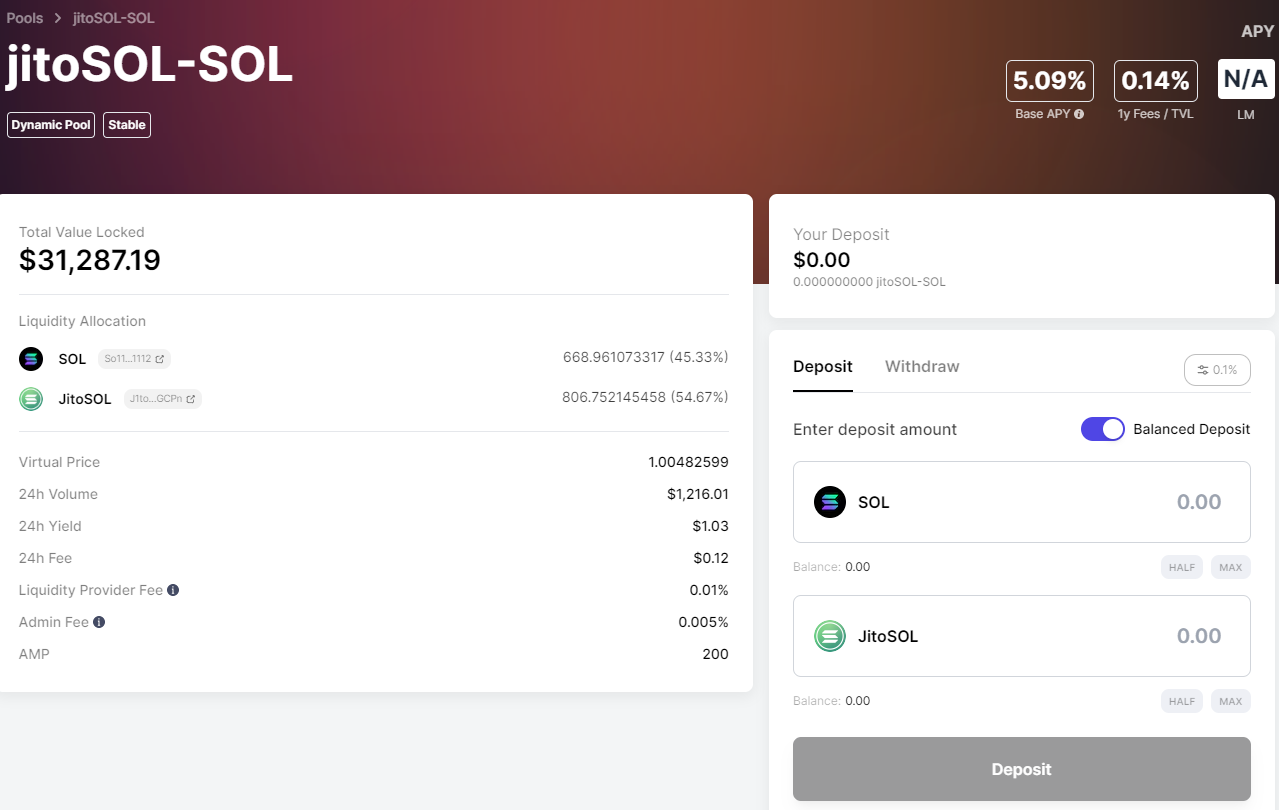

JitoSOL-SOL Pool

Meteora's JitoSOL-SOL stable dynamic pool:

- Earns trading fees and lending fees

- Automatically rebalances between AMM and lending based on demand

- Designed for stablecoin and correlated asset pairs

How DLMM Works

Price Bins: Liquidity is organized into discrete price ranges

- Each bin has specific price and liquidity amounts

- Eliminates slippage within individual bins

- Hybrid between order book and AMM

Dynamic Strategies:

- Spot: Uniform distribution across price ranges

- Curve: Concentrated around current price (low volatility)

- Bid-Ask: Inverse curve for high volatility assets

Getting Started

- Visit https://app.meteora.ag/pools/jitoSOL-SOL

- Connect your Solana wallet

- Choose distribution strategy

- Add JitoSOL and SOL to the pool

- Collect trading fees + staking rewards

Yield Sources

- Trading Fees: From JitoSOL-SOL swaps

- Lending Fees: When pool assets are lent out

- Staking Rewards: Continue earning on JitoSOL position

- Dynamic Rebalancing: Optimized fee collection

Resources

- Pool: https://app.meteora.ag/pools/ERgpKaq59Nnfm9YRVAAhnq16cZhHxGcDoDWCzXbhiaNw

- Documentation: https://docs.meteora.ag/amm-pools/dynamic-amm-pools

Best For: Users wanting automated liquidity management with minimal impermanent loss on correlated assets.